Virginia Motor Vehicle Bill of Sale

Is a Vehicle Bill of Sale Required in Virginia?

The Virginia state laws do not require purchasers and vendors to create and complete a bill of sale for a motor vehicle. Individuals wanting to purchase and sell a vehicle must complete an Application for Registration (Form VSA 14) and pay the required fees.

Additionally to this, they need to provide the following documents to the Virginia Department of Motor Vehicles (DMV) office:

-

Inspection certificate

-

Proof of residency

-

Proof of identity

-

Title for the vehicle

-

Proof of insurance

It still does not mean they do not need to complete a bill of sale for a motor vehicle. In Virginia, a bill of sale for a motor vehicle acts as a document proving your ownership of a vehicle. This paper's primary goal is to guarantee one obtains ownership over some exact vehicle. It is crucial to have this document as it can protect vendors and purchasers from possible legal issues in the future. All participants of the vehicle transferring process can include in a bill of sale for a motor vehicle as many details as possible, and all participants of this process need to agree with all the statements included in this document.

How to Fill Out the Virginia Vehicle Bill of Sale Form

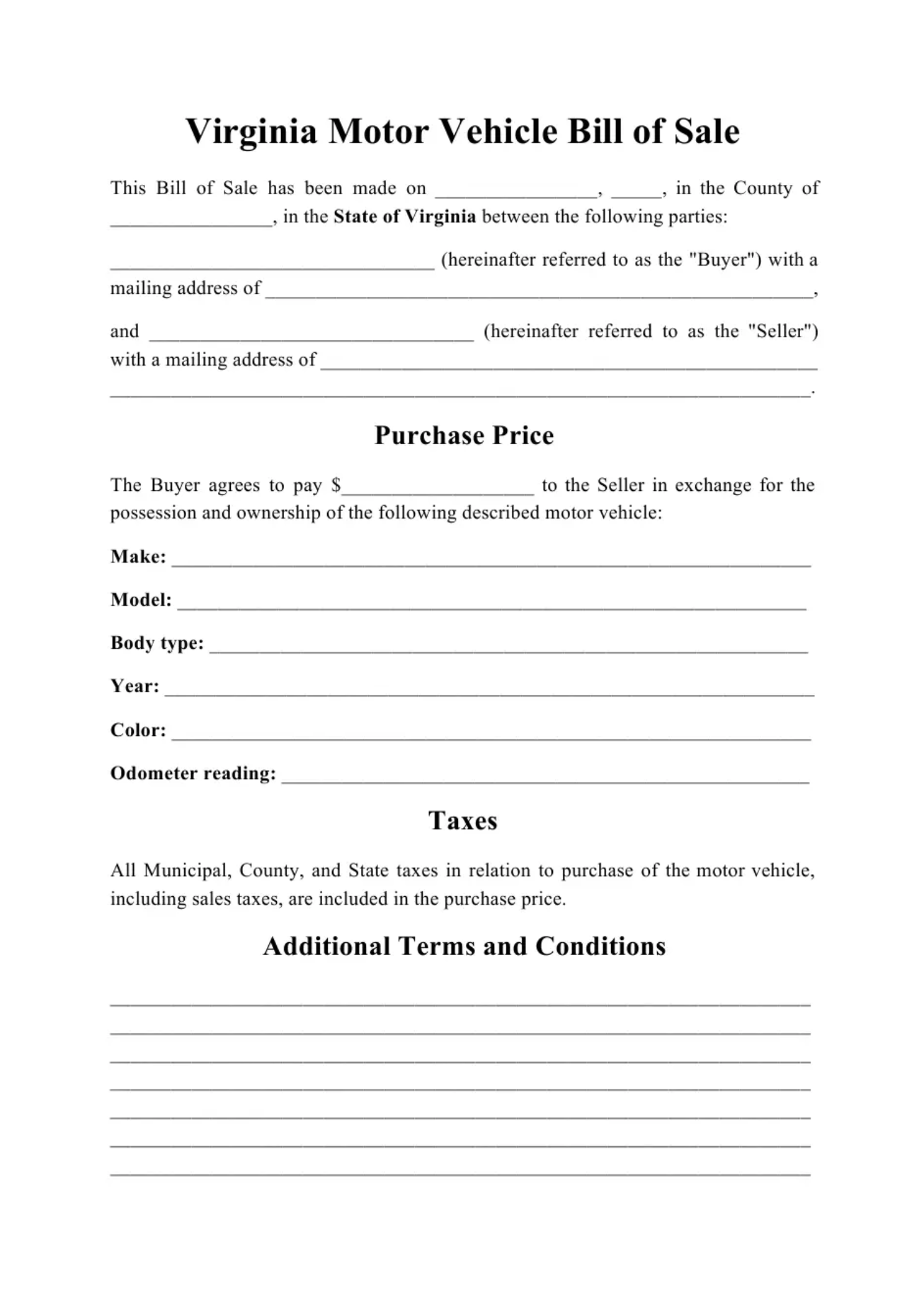

A vehicle bill of sale is a crucial legal tool to verify the vehicle's new owner and register the vehicle. Here's how to fill out the Virginia motor vehicle bill of sale:

Step 1: Vehicle Make, Model, and Year

Enter the vehicle name clearly and concisely.

Example: Ford F-150 Lariat 4x4 SuperCrew Cab 2013

Step 2: Personal or Company Name

If you are the business entering information on this form, add your legal company name here. If you are an individual filling out this form for your vehicle, enter your full legal first and last name here.

Example: Joe Blow

Step 3: Personal or Company Address

Enter your Virginia residential address where the vehicle will be registered (street address, city, state). If you are an individual filling out this form for your vehicle and it will be registered to a business address (street address, Virginia), then enter that business name here.

Step 4: Vehicle Identification Number (VIN)

Enter the VIN taken from the car or truck's dashboard at the bottom right-hand side of the windshield near where it reads "Vehicle Registration." If more than one VIN is listed on the vehicle (Attach additional pages if necessary), list all vehicle identification numbers found on ALL attached paperwork here.

Example: 1FTRX18LXXDG5XXXX

Step 5: Sale Price of Car/Truck

Enter the sale price of the car or truck. If you sell a car or truck for $1, do not enter a dollar sign ($) before it.

Step 6: Odometer Reading

Enter the odometer reading at the time of sale. This number should estimate how many miles the vehicle has been driven since it was manufactured (not the total number of miles the car or truck has been driven). The Virginia DMV requires this information to determine if sales and use tax is owed on your purchase.

Step 7: Gross Weight Class

Refer to the Virginia Department of Motor Vehicles (DMV) weight chart when deciding what class to use.

Example: GVW (Gross Vehicle Weight) is 2,500 lbs or less

Step 8: Sale Price and Type of Payment

Enter the sale price paid using cash, check, or credit card and what kind of payment it is, i.e., check "check" and credit card "credit."

Example: Sale Price – 7,000 Payment – Cash (Check), Credit Card (Credit)

Step 9: Sales Tax Rate and Amount Paid (Optional)

If sales tax was paid for this purchase, enter the sales tax rate and the taxable amount paid.

Step 10: DMV Sales Tax Rate (Optional)

If state sales tax was not paid on this purchase, enter in DMV sales tax rate of 4.15%

Step 11: Virginia Vendor Check Number (Optional)

Enter a vendor check number if one is available to reference your recent purchase made by a business. This information can be found by looking at your credit card statement or calling the company that processed your transaction. Example: Bill Me Later, Inc.

Always verify the most up-to-date and accurate information from the Tennessee Department of Revenue or your local county clerk's office before proceeding with the vehicle registration process.

Please Select another State below

Auto Bill of Sale for Virginia - VA. Do you want this form for another state? Select one: AL , AK , AZ , AR , CA , CO , CT , DE , DC , FL , GA , HI , ID , IL , IN , IA , KS , KY , LA , ME , MD , MA , MI , MN , MS , MO , MT , NE , NV , NH , NJ , NM , NY , NC , ND , OH , OK , OR , PA , RI , SC , SD , TN , TX , UT , VT , VA , WA , WV , WI , WY

Unlike free auto bill of sale form providers, our forms are professional and protect your rights. A standard vehicle bill of sale form is essential for your total legal protection.