Georgia Motor Vehicle Bill of Sale

Is a Vehicle Bill of Sale Required in Georgia?

Georgia vehicle bill of sale is a document used in deals concerning a motor vehicle purchase or sale. The paper ensures the rights of both parties are served and covers all necessary information regarding the personal details of the parties taking part in the deal and the data concerning the motor vehicle in question.

Regulations and requirements concerning the deals of vehicle transfer differ by state. In Georgia, the bill of sale is required when you sell or buy a motor vehicle.

First, it is a crucial document for vehicle registration. An adequately filled-out bill of sale document simplifies the entire procedure and minimizes complications arising after the deal.

To register a motor vehicle in Georgia, you will also need the following documents:

-

Vehicle Title

-

Proof of Identity

-

Proof of Insurance

-

Vehicle Emission Inspection Certificate

-

Vehicle Registration Application

If you have no title for your motor vehicle, the registration process is forbidden for you in the state of Georgia. You should file the vehicle bill of sale and an application to receive the title. However, car owners whose cars were released before 1986 do not need to have a title. The bill of sale covers the issue for them.

If you want to obtain a license plate for your motor vehicle in Georgia, you will also need to complete the bill of sale for your car. Check the latest updates of state laws to be sure you do everything the right way.

How to Fill Out a Georgia Bill of Sale?

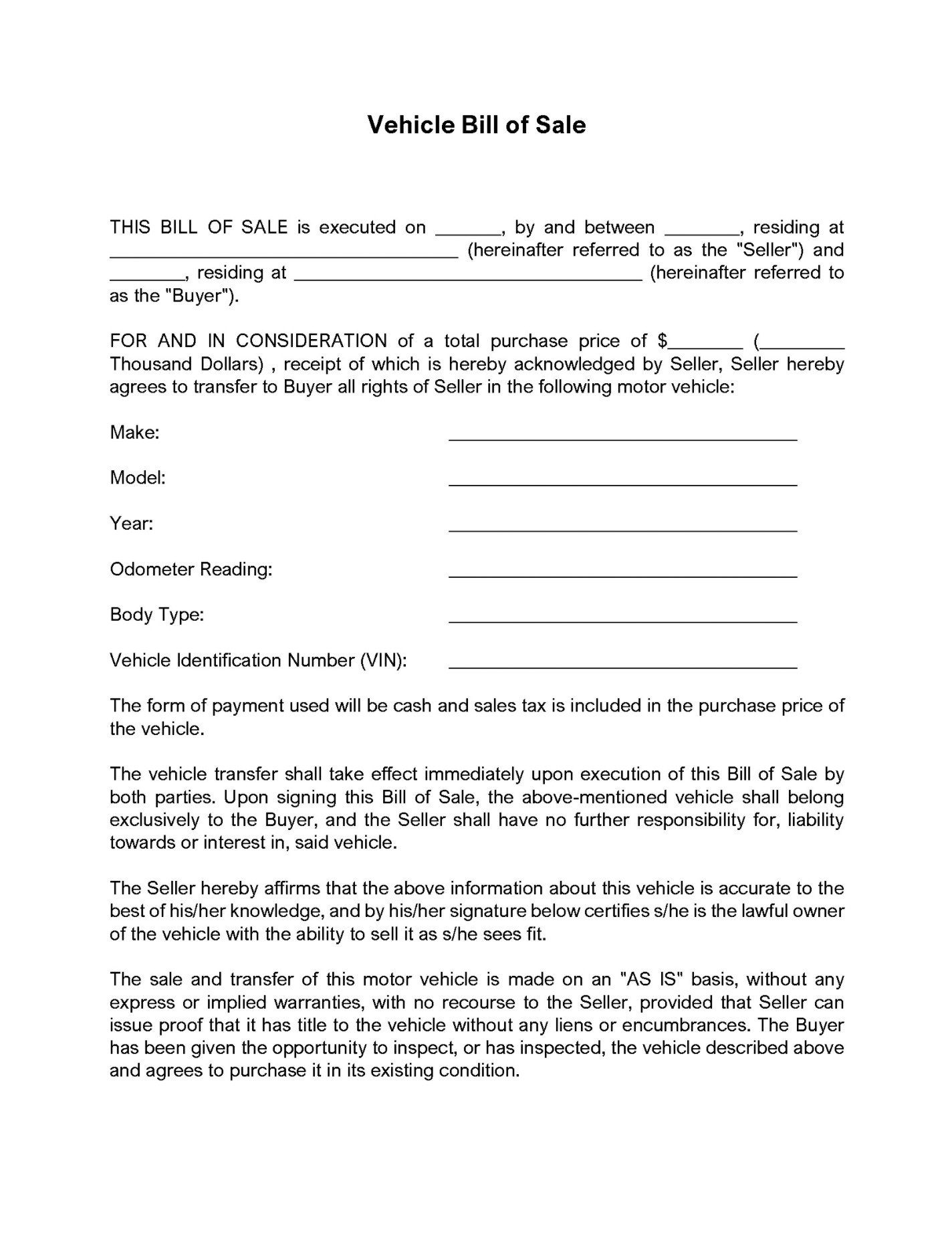

If you are purchasing a used vehicle in Georgia, it is crucial to fill out all necessary forms. One example of one such form is the Bill of Sale (Form T-7). Here's how to fill it out correctly.

This bill of sale is a legal document that establishes the terms of a vehicle sale and shows that the odometer reading was stated by the seller and accepted by the buyer.

If the sale is court-ordered, attach the court order and include the case number.

To fill out the form, you will need:

1. Sale transfer date: Enter the date of the sale on which this bill of sale is based.

2. Seller's name: Enter the seller's full legal name exactly as it appears on the identification used to complete the sale.

3. Seller's address: Enter the seller's address where they can be contacted by mail or telephone if there are problems with this bill of sale or any other documents related to this transaction that must be settled between you and the buyer. If no such address exists, enter your mailing address here, including city, state, and zip code.

4. Tax ID Number: Specify tax ID number from either a business license (sales & use tax), form T-4 ID for non-businesses filing a sales & use tax return, or a federal employer identification number (EIN).

5. Vehicle details: Enter the year, make, model, and vehicle identification number (VIN) of the sold vehicle.

6. Purchaser's name: Enter the purchaser's full legal name exactly as it appears on the identification used to complete the sale.

7. Purchaser's address: Enter the purchaser's address where they can be contacted by mail or telephone if there are problems with this bill of sale or any other documents related to this transaction that must be settled between the seller and the buyer.

8. Lienholder name and address: If there is a lienholder on the vehicle, enter that lienholder's name and address.

9. Odometer reading: Enter the odometer reading (without tenths) at the time of sale as indicated on the title or other document transferring ownership of the vehicle to the buyer. Alternatively, indicate if the reading does not correspond to the actual mileage or if it has exceeded the possible limit.

10. Information for Out-of-State Vehicles: If you purchase a used out-of-state vehicle in Georgia and this bill of sale will be recorded with your county, provide the following information (you may need to contact your county tax commissioner for assistance).

a. Purchase price: The total purchase price of the vehicle, including all money, property, and services given to the seller in exchange for title to the vehicle.

b. Trade-in allowance: The total value of any trade-in (or loan payoff) to be deducted from the purchase price.

c. Taxable amount: The taxable portion of the purchase price if this is an out-of-state vehicle and not a Georgia dealer sale (the taxable amount should be calculated according to your county's sales tax rate).

d. Purchaser's county in Georgia and the county's sales tax rate: If you are purchasing a used out-of-state vehicle in Georgia, provide your purchaser's county name and the sales tax rates for that particular county to be included on the Form T-4, Schedule 2.

e. Tax due amount: The total sales tax due on the taxable purchase price of the vehicle. This amount should be entered on Form T-7, Line 11d, and Form T-4, Schedule 2, Line 4.

f. Credit: If the due tax amount is less than the total amount of sales tax paid to date on this vehicle (including any amounts paid in other states), enter the credit here.

g. Sales tax due: The total amount of sales tax currently owed on the purchase price of this vehicle (should match the amount entered on line 11d above). This amount should be entered on Form T-7, Line 12, and Form T-4, Schedule 2, Line 5.

11. Signatures of buyer and seller: Make sure both the purchaser's signature and yours are on this bill of sale for this transaction to be valid. The Georgia Department of Revenue recommends including this information in each document that will be recorded to protect both parties interests.

Once you have filled out all the required information on this form, make sure you save a copy for your records. You will need it in case of any disputes down the road.

If you have any questions about this form or need help filling it out, don't hesitate to contact the Georgia Department of Revenue. They will be more than happy to assist you.

This article is not a substitute for legal advice. If you have questions about filling out this form, please consult an attorney.

Please Select another State below

Auto Bill of Sale for Georgia - GA. Do you want this form for another state? Select one: AL , AK , AZ , AR , CA , CO , CT , DE , DC , FL , GA , HI , ID , IL , IN , IA , KS , KY , LA , ME , MD , MA , MI , MN , MS , MO , MT , NE , NV , NH , NJ , NM , NY , NC , ND , OH , OK , OR , PA , RI , SC , SD , TN , TX , UT , VT , VA , WA , WV , WI , WY

Unlike free auto bill of sale form providers, our forms are professional and protect your rights. A standard vehicle bill of sale form is essential for your total legal protection.