Alabama Motor Vehicle Bill of Sale

Is a Vehicle Bill of Sale Required in Alabama?

The transfer of vehicle ownership must be accompanied by the execution of certain documents. In Alabama, an auto bill of sale is required to register any motor vehicle. While Alabama does not mandate that the bill of sale be notarized, it is still a crucial document that provides legal proof of the transaction and helps protect both the buyer and the seller. The document is also necessary for you for the personal accounting of property.

To complete the bill of sale and register a vehicle in Alabama, you are given 20 days, starting from the date of purchase.

The buyer should gather all required documentation, including the completed car bill of sale, the vehicle's title properly assigned to the new owner, and a valid form of identification. Additionally, the buyer should obtain a properly executed odometer disclosure statement if the vehicle is less than ten years old. With these documents in hand, the buyer should visit the local Alabama Department of Revenue (DOR) office or an authorized tag and title service provider. At the DOR office, the buyer will need to submit the completed bill of sale, the vehicle's title, proof of insurance, and payment for registration fees, title transfer, and applicable taxes. Following these steps will enable a new vehicle owner to complete the registration process smoothly and in compliance with Alabama's regulations.

To sum up, the documents that will be required for the registration process:

-

Car bill of sale

-

Odometer disclosure statement

-

Liability insurance (a copy)

-

Vehicle title (if you do not have any, you need to fill out Form MVT 12-1)

The Alabama Department of Revenue (DOR) recommends using a bill of sale to record the transfer of ownership accurately and to include essential information about the vehicle, the buyer, the seller, and the terms of the sale.

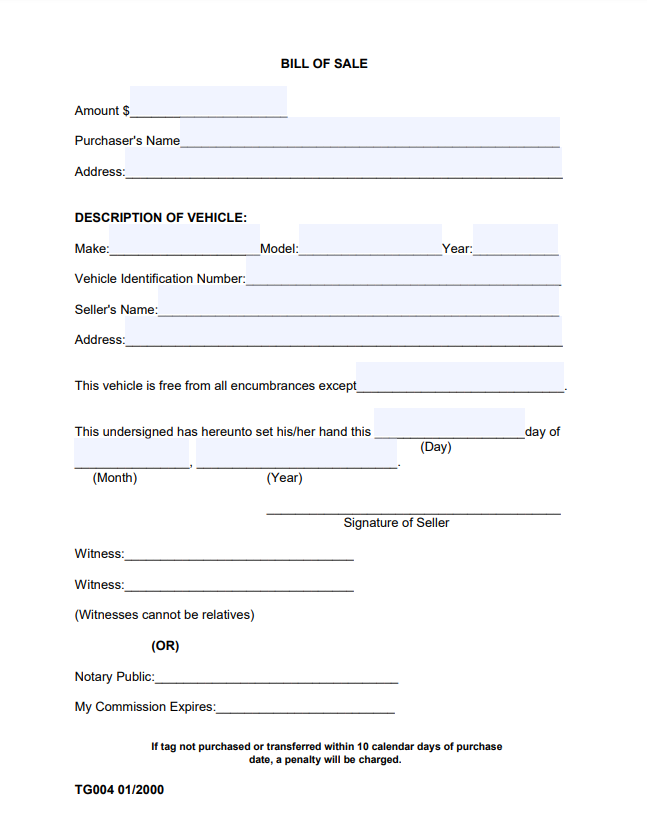

Main Components of the Bill of Sale

Alabama vehicle bill of sale is an essential legal tool, as it serves as a binding document protecting the interests of both the buyer and the seller during the sale of a motor vehicle. However, you must accurately prepare the document to obtain a valid bill of sale in your state.

It is best to check this list with your local Department of Revenue to have the latest information for your county. However, in most areas, the bill of sale must include the following parts:

-

Buyer’s name and contact data

-

Seller’s name and contact data

-

Vehicle identification number (or VIN)

-

Odometer reading (if applicable)

-

Sales date

-

Vehicle’s body type and series number

-

Vehicle’s year, model, and make

-

Purchase price

-

Buyer’s and seller’s signatures

While not having a Bill of Sale doesn't necessarily invalidate the ownership transfer, it can make the process more legally ambiguous and potentially lead to future complications. Therefore, using a Bill of Sale when buying or selling a vehicle in Alabama is highly recommended to ensure a smooth and transparent transaction.

Please Select another State below

Auto Bill of Sale for Alabama - AL. Do you want this form for another state? Select one: AL , AK , AZ , AR , CA , CO , CT , DE , DC , FL , GA , HI , ID , IL , IN , IA , KS , KY , LA , ME , MD , MA , MI , MN , MS , MO , MT , NE , NV , NH , NJ , NM , NY , NC , ND , OH , OK , OR , PA , RI , SC , SD , TN , TX , UT , VT , VA , WA , WV , WI , WY

Unlike free auto bill of sale form providers, our forms are professional and protect your rights. A standard vehicle bill of sale form is essential for your total legal protection.